J Gopikrishnan / New Delhi

September 30, 2025

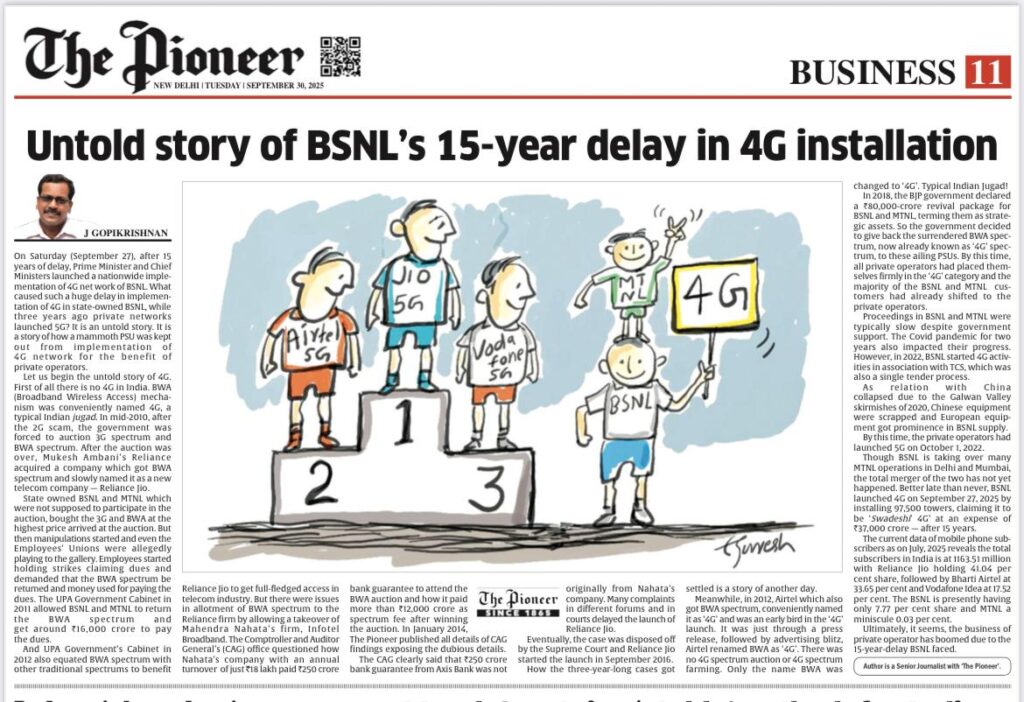

On Saturday (September 27), after 15 years of delay, the Prime Minister and Chief Ministers launched a nationwide implementation of 4G network of BSNL. What caused such a huge delay in the implementation of 4G in state-owned BSNL, while three years ago, private networks launched 5G? It is an untold story. It is a story of how a mammoth PSU was excluded from the implementation of the 4G network for the benefit of private operators.

Let us begin the untold story of 4G. First of all, there is no 4G in India. BWA (Broadband Wireless Access) mechanism was conveniently named 4G, a typical Indian jugad. In mid-2010, after the 2G scam, the government was forced to auction 3G spectrum and BWA spectrum. After the auction was over, Mukesh Ambani’s Reliance acquired the BWA spectrum and subsequently established a new telecom company, named Reliance Jio.

State-owned BSNL and MTNL, which were not supposed to participate in the auction, bought the 3G and BWA at the highest price arrived at the auction. But then manipulations started and even the Employees’ Unions were allegedly playing to the gallery. Employees started holding strikes, claiming dues and demanded that the BWA spectrum be returned and the money used for paying the dues. The UPA Government Cabinet in 2011 allowed BSNL and MTNL to return the BWA spectrum and get around Rs 16,000 crore to pay the dues.

And the UPA Government’s Cabinet in 2012 also equated BWA spectrum with other traditional spectrums to benefit Reliance Jio to get full-fledged access in the telecom industry. But there were issues in the allotment of BWA spectrum to the Reliance firm by allowing a takeover of Mahendra Nahata’s firm, Infotel Broadband. The Comptroller and Auditor General’s (CAG) office questioned how Nahata’s company, with an annual turnover of just Rs 18 lakh, paid Rs 250 crore bank guarantee to attend the BWA auction and how it paid more than Rs 12,000 crore as spectrum fee after winning the auction. In January 2014, The Pioneer published all details of CAG findings exposing the dubious details.

The CAG clearly said that Rs 250 crore bank guarantee from Axis Bank was not originally from Nahata’s company. Many complaints in different forums and in courts delayed the launch of Reliance Jio. Eventually, the case was disposed of by the Supreme Court and Reliance Jio started the launch in September 2016. How the three-year-long cases got settled is a story for another day.

Meanwhile, in 2012, Airtel, which also got BWA spectrum, conveniently named it as ‘4G’ and was an early bird in the ‘4G’ launch. It was just through a press release, followed by an advertising blitz, Airtel renamed BWA as ‘4G’. There was no 4G spectrum auction or 4G spectrum farming. Only the name BWA was changed to ‘4G’. Typical Indian Jugad!

In 2018, the BJP government declared a Rs 80,000-crore revival package for BSNL and MTNL, terming them as strategic assets. So the government decided to give back the surrendered BWA spectrum, now already known as ‘4G’ spectrum, to these ailing PSUs. By this time, all private operators had placed themselves firmly in the ‘4G’ category and the majority of the BSNL and MTNL customers had already shifted to the private operators.

Proceedings in BSNL and MTNL were typically slow despite government support. The COVID pandemic for two years also impacted their progress. However, in 2022, BSNL started 4G activities in association with TCS, which was also a single tender process. As relations with China collapsed due to the Galwan Valley skirmishes of 2020, Chinese equipment was scrapped and European equipment got prominence in BSNL supply. By this time, the private operators had launched 5G on October 1, 2022.

Though BSNL is taking over many MTNL operations in Delhi and Mumbai, the total merger of the two has not yet happened. Better late than never, BSNL launched 4G on September 27, 2025, by installing 97,500 towers, claiming it to be ‘Swadeshi’ 4G’ at an expense of Rs 37,000 crore — after 15 years.

The current data of mobile phone subscribers as of July 2025 reveals that the total subscribers in India are at 1163.51 million, with Reliance Jio holding 41.04 per cent share, followed by Bharti Airtel at 33.65 per cent and Vodafone Idea at 17.52 per cent. The BSNL is presently having only 7.77 per cent share and MTNL a minuscule 0.03 per cent.

Ultimately, it seems, the business of the private operator has boomed due to the 15-year delay BSNL faced.

The author is a Senior Journalist with ‘The Pioneer’.